Walmart’s Learning Loop: How the Retail Giant Is Turning Scale into Intelligence

AI sensors, real-time data, and scale economics are reshaping how the world’s largest retailer learns

Executive Summary

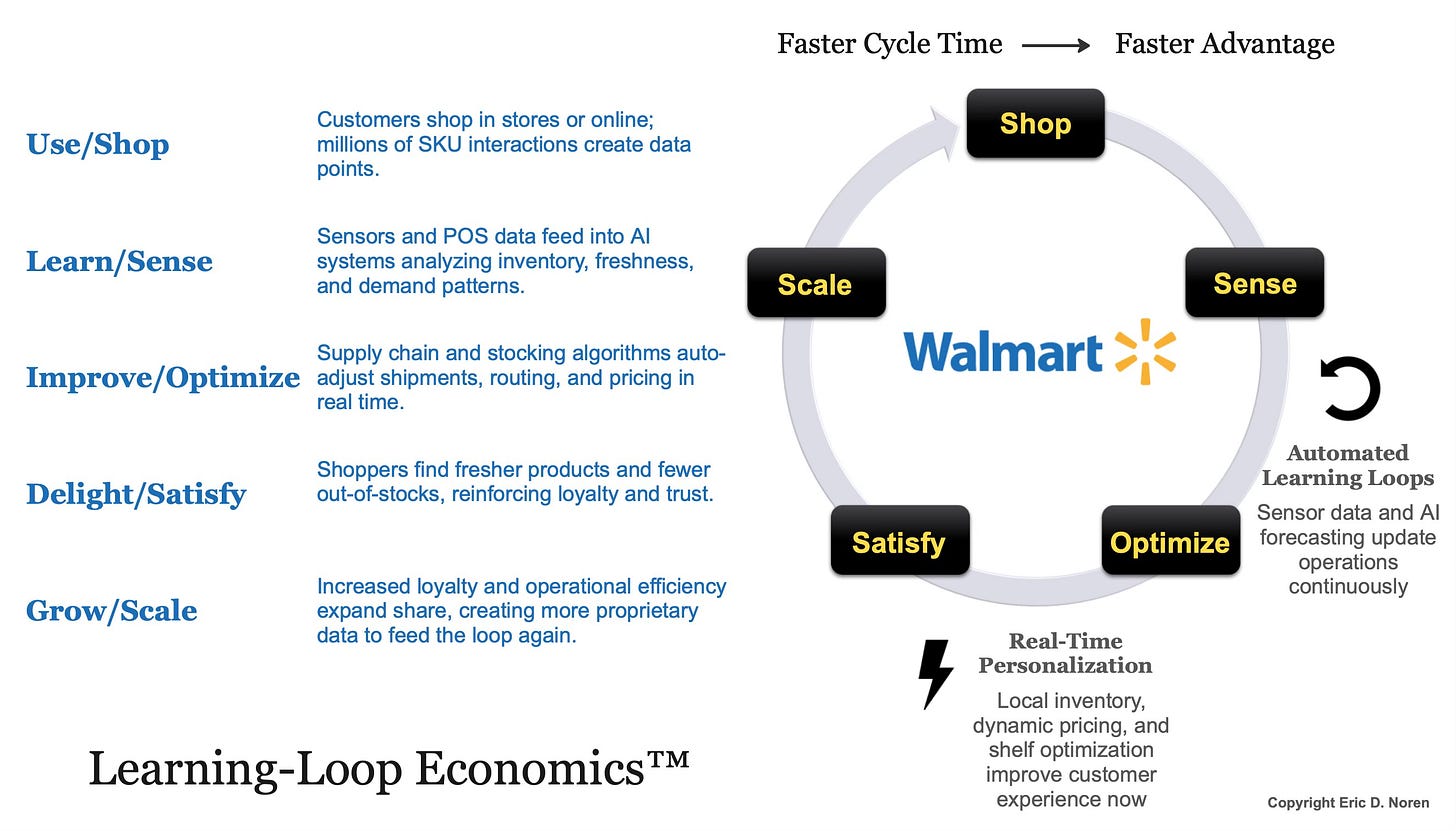

In AI-intensive businesses, advantage compounds when operational scale is converted into proprietary learning loops. Walmart is transforming cost leadership into an information advantage by instrumenting its value chain and tightening closed feedback cycles. The mechanism is Learning-Loop Economics: exclusive data capture multiplied by cycle speed produces compounding strategic distance. When feedback becomes continuous and gated, operational efficiency evolves into a self-reinforcing intelligence system.

In learning-loop systems, data exclusivity multiplied by cycle speed determines the long-run distance between competitors.

Strategic Mechanism

This system converts operational interactions into a closed, accelerating learning loop.

Exclusive sensors and POS capture continuous proprietary interactions across the value chain.

Signals update forecasting, replenishment, and scheduling models through automated near-real-time learning loops.

Operational states change probabilistically as updated models propagate across integrated execution layers.

Revised states generate additional gated interactions, increasing data exclusivity and cycle speed each iteration.

Automated Learning Loops and Real-Time Personalization tighten feedback at multiple decision layers.

Loop strength scales with the product of cycle speed and data exclusivity within a closed architecture.

Prefer to listen? Here’s the audio edition of this post:

When I leave my grocery list at home, I end up walking through the aisles in a daze, trying to remember if I needed milk or butter or both. (Truthfully, my list is always on my phone, but play along.). Walmart, on the other hand, increasingly knows exactly what it owns, where it is, and even whether it is still fresh. That is not an accident. It is the direct result of a deliberate strategy to instrument its supply chain and accelerate its ability to learn.

This is where my theory of Learning-Loop Economics™ comes in to the strategic discussion. The core idea is simple: in the AI era, faster feedback loops create compounding advantage. The companies that learn the quickest do not just improve incrementally; they build structural moats that widen over time. Walmart, of all companies, is becoming a case study in how to make that principle real.

What Is Learning-Loop Economics?

In Learning-Loop Economics, the broader business cycle runs through five stages — Use, Learn, Improve, Delight, and Grow. In AI-intensive contexts like Walmart’s, that same loop can be simplified to its data mechanics: proprietary interactions → model updates → product improvements → more interactions.

The strength of this loop depends on two things: cycle speed (how quickly feedback turns into change) and data exclusivity (whether the learning is proprietary and gated). Multiply those factors, and you get the loop’s overall strength.

For a company to benefit, three preconditions need to be in place:

Exclusive data capture: The loop must be built on signals rivals cannot easily access.

Tightly integrated architecture: The organization must be able to funnel data into systems that can act on it.

Rapid feedback tempo: The shorter the delay between signal and action, the stronger the compounding effect.

Once in place, leaders can deploy specific tactics to build their own learning loop:

Instrument everything

Shorten the loop

Gate the loop

Market the intelligence

Align incentives for learning

With those conditions and tactics, a company can turn ordinary operations into a compounding machine. I can demonstrate Learning-Loop Economics using Walmart as the example.

Walmart’s Sensor Strategy

Walmart recently announced that it will expand its use of sensors from pilot sites to its entire U.S. footprint: about 4,600 stores and 40 distribution centers. These sensors, built by a startup called Wiliot, are about the size of a postage stamp. They do not need batteries; instead, they harvest energy from surrounding radio waves and use Bluetooth to transmit data.

That data stream is rich: location, condition, and temperature of pallets across the supply chain. Historically, Walmart employees had to scan products manually, which meant data arrived in slow, discrete snapshots. Now Walmart will receive a continuous feed, down to the pallet level, across millions of items moving every day.

This is what it means to “instrument everything.” Walmart is not just installing technology to automate a tedious task. It is laying the foundation for exclusive, real-time data capture that fuels a closed learning loop.

How Walmart’s Learning Loop Works

Let’s walk through how this fits the Learning-Loop Economics cycle.

Proprietary interactions: Every sensor ping is an exclusive signal that Walmart owns.

Model update: Walmart’s AI systems ingest the data and update forecasts, replenishment plans, and workforce schedules.

Product improvement: Shelves stay stocked, spoilage declines, and employees spend less time searching and more time serving.

More interactions: Customers experience fewer out-of-stocks and fresher groceries, which leads to higher loyalty and repeat visits.

Each loop makes the next one stronger. The company is not only improving efficiency today, it is building a dynamic system that gets smarter with every pallet moved. The more data Walmart captures, the faster the cycle runs, and the greater the distance grows between it and rivals.

Let’s take a look at Walmart’s learning-loop. It starts at Shop: customers buy in stores or online, creating millions of SKU-level interactions. Those interactions flow to Sense, where sensors and POS systems capture location, condition, and temperature signals, then feed Walmart’s AI. Next is Optimize: forecasting and replenishment algorithms adjust shipments, routing, staffing, and, where appropriate, pricing in near real time. The result is Satisfy: fewer out-of-stocks, fresher perishables, and a smoother trip, which reinforces trust and repeat visits. That momentum drives Scale: loyalty and efficiency expand share, generating even more proprietary data to feed the next turn of the loop. Two accelerators tighten the cycle and deepen advantage: Automated Learning Loops keep operations updating continuously as new signals arrive, and Real-Time Personalization — local inventory visibility, dynamic pricing, and shelf optimization — lets shoppers experience the improvement now. Faster cycle time, plus gated data, compounds into sustainable advantage.

The diagram below summarizes how Walmart’s feedback loop translates these ideas into practice.

Why This Matters for Walmart’s Advantage

Traditionally, Walmart’s strategy has been defined by its position as a Low Cost [Lo] Traditional Retailer [Rt], relying on an Economies of Scale [Es] advantage, logistics efficiency, and bargaining power to keep prices down. That advantage is real, but it has long been imitable: other retailers can also chase efficiency, even if they can’t match Walmart’s depth of scale.

What’s changing now is the formula that powers its advantage. Walmart is developing an additional Superior Access to Information [I] advantage — using data to reinforce its cost leadership. By capturing real-time, proprietary signals from across its supply chain, the company is turning its operational footprint into a live information network.

Tactically, this shift is supported by instrumenting the value chain, automating feedback, and applying AI to tighten the cycle between signal and action. These choices don’t replace Walmart’s foundational elements — they amplify them. In effect, the company is upgrading its strategic formula from (Rt + Lo) × Es to (Rt + Lo) × Es × I, transforming operational efficiency into a compounding information advantage.

Competitors now face a structural dilemma: either build equivalent data architectures and feedback loops — an enormous investment with uncertain payoff — or operate at a permanent information disadvantage. Walmart’s loop will turn faster each quarter, and with it the durability of its low-cost advantage grows stronger.

What Other Businesses Can Learn

Walmart may seem like an unusual company to highlight in a conversation about AI, but that’s the point. Learning-Loop Economics is not limited to Silicon Valley or software. It applies anywhere feedback can be accelerated and data can be gated.

The questions leaders should ask are simple:

Are we operating on static snapshots, or have we instrumented our systems for continuous signals?

When we do collect data, how quickly does it cycle back into product or service improvements?

Most importantly, are those loops proprietary, or could a rival tap into the same signals?

The answers determine whether a company is compounding advantage, or simply working harder to stay in place.

Where This Goes Next

I expect Walmart’s sensors to be just the start. Once the architecture is in place, the company can use the same loop to optimize energy usage in refrigeration, reduce shrinkage from spoilage, and even anticipate customer demand shifts by analyzing purchase patterns against supply-chain data.

That is the nature of learning loops: each improvement sets the stage for the next. Faster cycles create not just better operations, but a fundamentally different type of company.

Strategic Takeaway: Learning Loops as the New Advantage

Learning-Loop Economics explains why AI is not simply an overlay on existing businesses — it rewrites the physics of advantage. Walmart’s use of sensors and automation shows how a classic low-cost retail formula can evolve to incorporate artificial intelligence — making information itself the multiplier.

If the world’s archetype of scale and efficiency is reinventing its business as a continuous learning loop, then no company can afford to stand still. In the AI era, advantage flows to those who learn fastest — and compound what they learn.

Canonical definition: Learning-Loop Economics.

About the author: Eric D. Noren is VP of Digital Operations & Growth at Foundation Partners Group and the creator of the Strategic Formula System, including the Periodic Table of Business Strategy™, the AI Susceptibility Index™, and Learning-Loop Economics™. Learn more at ericdnoren.com.